Chegg Perform the Experiment in Part B Again This Time

#12: A Startup Case Study: Chegg

Product strategy tools and frameworks practical to a textbook rental and didactics startup that now has a $10B market cap.

In 2010, I joined Chegg as Master Production Officer. The company was founded in 2001 every bit "Craigslist for college students" simply didn't get traction until it launched textbook rental in 2008. By the end of my first twelvemonth at Chegg, we generated $150M in revenue.

The GLEe Model

Here's how I applied the GLEe model to Chegg in 2010:

Chegg Product Vision

- Get Large on Textbooks

- Lead eTextbooks

- Aggrandize into other educatee services (jobs, internships, etc.)

Information technology was clear that we could become big on textbook rental. Our service provided overwhelming value to students who could hire a textbook for $50 instead of ownership a new book for $200. One clear sign of our ability to delight higher students: our Cyberspace Promoter Score speedily improved from l to the high seventies.

Similar to Netflix, I thought Chegg would transition from concrete delivery to digital services in iii–5 years, simply I was wrong. There are three reasons the transition to eTextbooks nonetheless hasn't happened:

- While I expected students to exist early adopters, they were the contrary. Students had a nostalgic relationship with physical books. They spoke longingly about sitting on their parent'due south laps every bit their parents read books to them, and had little interest in eTextbooks.

- Concrete books offered advantages students valued that eTextbooks couldn't match, most noticeably the ability to highlight text using a marker.

- Publishers insisted on pricing eTextbooks shut to the price of a new physical textbook. They had no interest in disrupting their highly profitable paper textbook business.

Like most things involving consumer scientific discipline, the above insights seem relatively obvious today, but the discovery process was long.

As our textbook rental concern grew, nosotros set up our sights on a new expanse to pb: homework assist. We began by providing footstep-by-step solutions to all the answers in textbooks. After, nosotros expanded into other homework help areas — writing aid, tutoring, flashcards — to create a monthly subscription service called "Chegg Study." Today, nearly half of Chegg'due south revenues come from its digital services.

And then in 2012, when information technology became clear that eTextbooks would not exist a significant part of our business, we amended the "GLEe" model:

- Go Large on textbook rental.

- Lead homework help.

- Aggrandize into other student services.

Chegg is notwithstanding in the early days of its broader "pupil services" phase, only they'll get there. They're now a public company approaching $400 million in acquirement and have a market cap of $10 billion.

The DHM Model

Here are the ideas we explored to delight customers, build difficult to copy advantage, and generate margin:

Delight

- Provide overwhelming value through low-price, textbook rentals.

- Deliver fast admission to textbooks via a digital "Read While You Wait" eTextbook characteristic.

- Offer a 21-day return policy in case a pupil drops a class or the professor doesn't use the textbook.

- Provide footstep-by-pace solutions to all the questions in the back of textbooks.

- Set up kiosks in campus bookstores to arrive easy to rent textbooks.

- Enable students to buy and sell class notes.

Hard to copy advantage

- Create a "student graph." Nosotros built a dataset of all courses on each campus. Information technology included all the textbooks and content that were part of the course.

- Develop unique, personalization technology. We built this capability using the student graph data, above.

- Achieve economies of scale through high-volume, used textbook purchases.

- Build a viral brand, spread campus-wide through large, highly visible, orangish boxes.

- Create a network effect through a "homework help platform" where tutors around the globe provide answers on Chegg'due south platform.

Margin-enhancing

- Execute ongoing price tests for textbook rentals, precisely determining the balancing act between volume and margin.

- Experiment with gratuitous v. paid shipping.

- Launch an ad/sponsorship business via free items in each box, as well equally on-site banners and sponsored areas/services.

- Explore eTextbooks and the high-margin digital services we hoped they would provide.

Bringing D, H, & M together to form high-level strategies

In sorting through the "DHM" ideas and experiments in a higher place, nosotros teased out the post-obit production strategies.

- Student graph

- Personalization

- Social (a Facebook-manner newsfeed based on pupil graph data)

- Toll & selection

- High-margin, digital services

- Build make, awareness, and trial

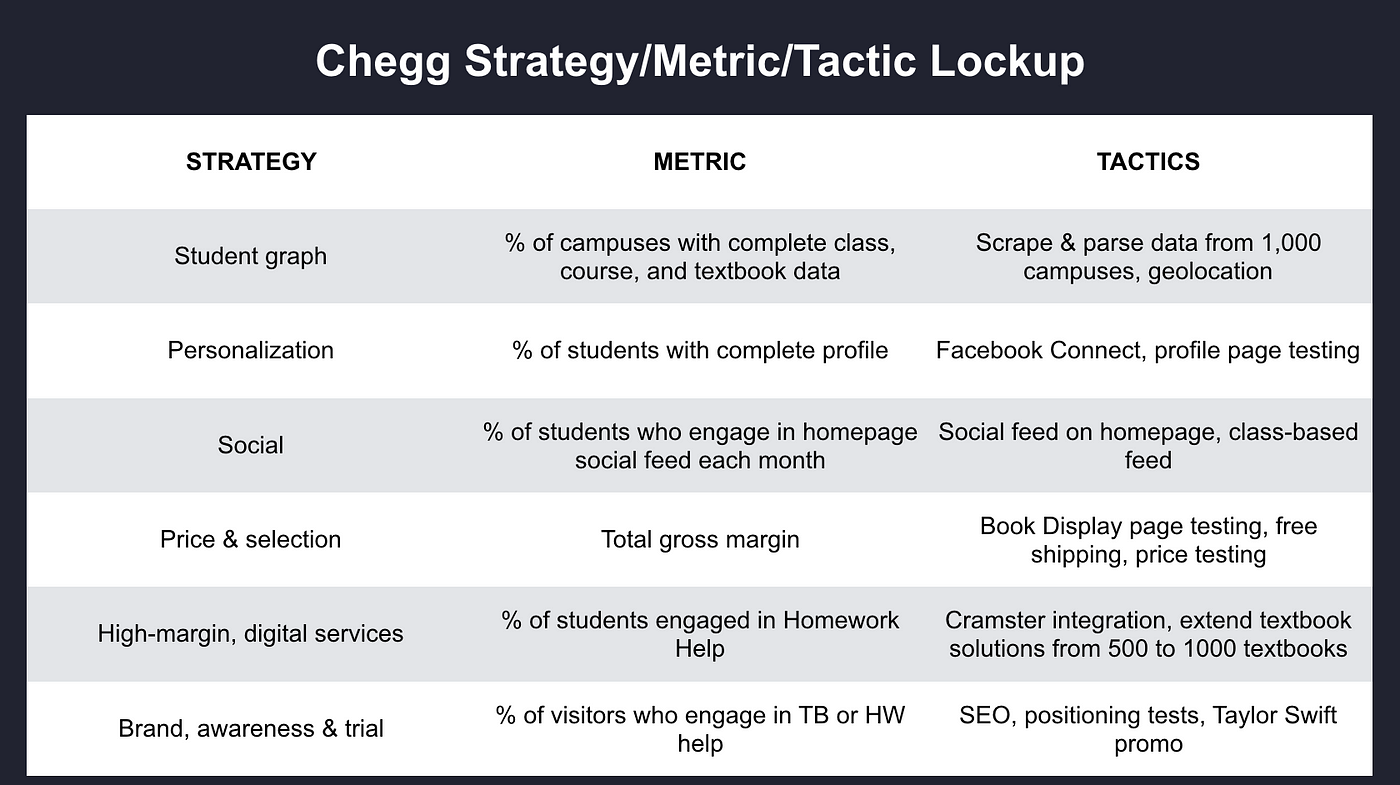

The Strategy, Metric, Tactic Lockup

Beneath is the lockup for Chegg, circa 2011:

The Gem model

When I joined Chegg, nosotros debated the prioritization of growth, engagement, and monetization. Dan Rosensweig, our CEO, was confident in our power to raise capital and prioritized "Precious stone" as follows:

- Growth, measured by yr-over-twelvemonth growth in student accounts and revenues.

- Engagement, measured by six-month textbook retention, Net Promoter Score, and, afterwards, homework aid monthly retention.

- Monetization, measured by turn a profit, greenbacks flow, and unit economic science.

Our CFO, Greg, was more than concerned about our ability to demonstrate a working textbook rental concern model. At the fourth dimension, we took it on faith that nosotros could buy a used textbook for $50, and then rent information technology three times over three years to evangelize profitable business. Unfortunately, it would accept 3 years to prove the model, and we couldn't simply press the pause push button — the job of a startup is to abound fast.

Dan and Greg's differing opinions created lots of tension. Somewhen, there was a scrap of a "cage match," and they aligned against the following forced rank:

- Growth

- Engagement

- Monetization

Dan's confidence in his ability to raise money to fund growth won out over Greg's desire to slow things down to prove our unit economics. There is no right answer — this is a classic, "y'all'll never know the road non taken" situation. But we did manage to raise multiple rounds of funding, to prove the business concern model, and to grow 25% year-over-twelvemonth. In tardily 2013 nosotros took the company public.

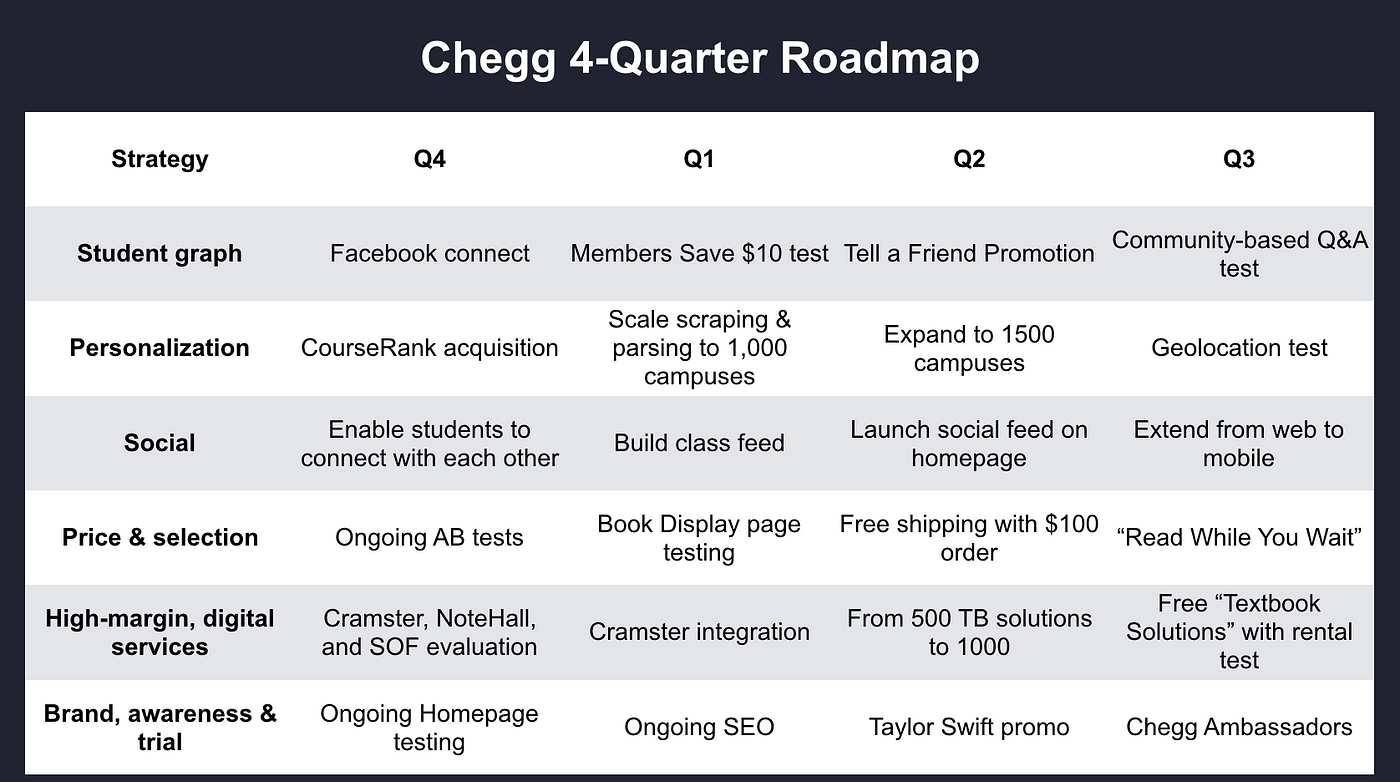

The Rolling iv-Quarter Production Roadmap

Below I take outlined the production roadmap. As always, I reinforced that next quarter's projects would happen on a timely basis but downplayed our power to deliver projects in subsequent quarters. I reinforced that in that location would exist then much learning in the next quarter that plans would likely change. Nevertheless, our iv-quarter production programme told a story of how our swimlanes fit together and how the strategies would come to life, over time.

Every bit always, the roadmap does not include all projects. I did non detail non-customer-facing projects (similar the financial systems required to go public). The roadmap provided a relatively high-level view that demonstrated how the production strategies might play out over time.

The last essay in this production strategy series follows. I have brought all the exercises together into i article so you lot can have a stride by pace approach to course your product strategy. I have also provided Google Slides and then you can "fill in the blanks" to build a SWAG — a Stupid Wild-Ass Guess — of your product strategy.

Terminal Essay, #thirteen: Step past Stride Exercises to Build Your Product Strategy

If you cull not to become on to build a prototype product strategy, please have a moment to requite me feedback on this 12-part essay. Your feedback is incredibly helpful to me:

Click here to give feedback — information technology only takes 1 minute!

Many thanks,

Gib

Gibson Biddle

PS. Many thanks to Filip Kaliszan, Chuck Geiger, Ciaran Doyle, and Brent Tworetzky for editing help.

www.gibsonbiddle.com

PS. Here's an index of all the manufactures in this series:

- Intro: How to Define Your Product Strategy

- #1 "The DHM Model"

- #ii "From DHM to Product Strategy"

- #three "The Strategy/Metric/Tactic Lock-up"

- #4 "Proxy Metrics"

- #5 "Working Bottom-upward"

- #6 "A Product Strategy for Each Swimlane"

- #seven "The Product Roadmap"

- #8 "The GLEe Model"

- #9 "The Gem Model"

- #10 "How to Run A Quarterly Product Strategy Coming together"

- #xi "A Case Study: Netflix 2020"

- #12 "A Startup Instance Written report: Chegg"

- #xiii "TLDR: Summary of the Product Strategy Frameworks"

- Click here to purchase my cocky-paced Product Strategy Workshop on Teachable for $200 off the regular $699 price. The course includes recorded talks, PDFs, and my essays along with pre-formatted Google Slides so you lot can consummate your product strategy on your own. You lot can also "try before you buy" — the first 2 modules are gratuitous.

Source: https://gibsonbiddle.medium.com/11-case-study-chegg-8044679939f9

0 Response to "Chegg Perform the Experiment in Part B Again This Time"

Post a Comment